First Home Buyer Loans Tailored to Your Needs

Buying your first home is a significant milestone and a dream come true. Our brokers ensure no financial constraints stand between you and your dream home. At Original Wealth, our vast network of 40 bank and non-bank lenders secures your access to hundreds of mortgage products. This means you will be sure to find a first home loan product that best aligns with your financial situation and goals. With us by your side, you make wise investment decisions that fulfill your present needs without overburdening your future finances.

For a first-time home buyer, there are several grants like the First Home Owner Grant (FHOG) or stamp duty concessions that could help you save thousands. With us as your first home buyer mortgage broker, you will be sure to secure all eligible grants and proceed right in your home ownership journey. With varying interest rates, eligibility criteria and terms and conditions, the mortgage market is complex. But we simplify it all for you – our first home buyer brokers will guide and support you each step of the way and secure a seamless experience. With us, you stay informed and confident – no jargon or complicated bank terminology, just straightforward, simple advice and end-to-end support.

Make way for competitive rates and favourable loan terms with us at Original Wealth.

Award-Winning Expertise, Backed by Results

2024

Top 100 Brokers

2024-2025

Elite Broker

2023-2024

Highest Number of Loans Settled

2023-2024

Highest Dollar Volume

2024

MQG Diamond Club

2024

Top Brokerage MPA Australia

2023

MPA Top 100 Brokers in Australia

2021

MPA Top 100 Brokers in Australia

2019-2020

Franchise of the Year (VIC)

2019-2020

Managing Director's Rising Star Award

2023

Choice Platinum Achiever

2020-2021

Franchise of the Year (VIC/TAS)

2020-2021

National Mortgage Broker of the Year

2022

Choice Platinum Achiever

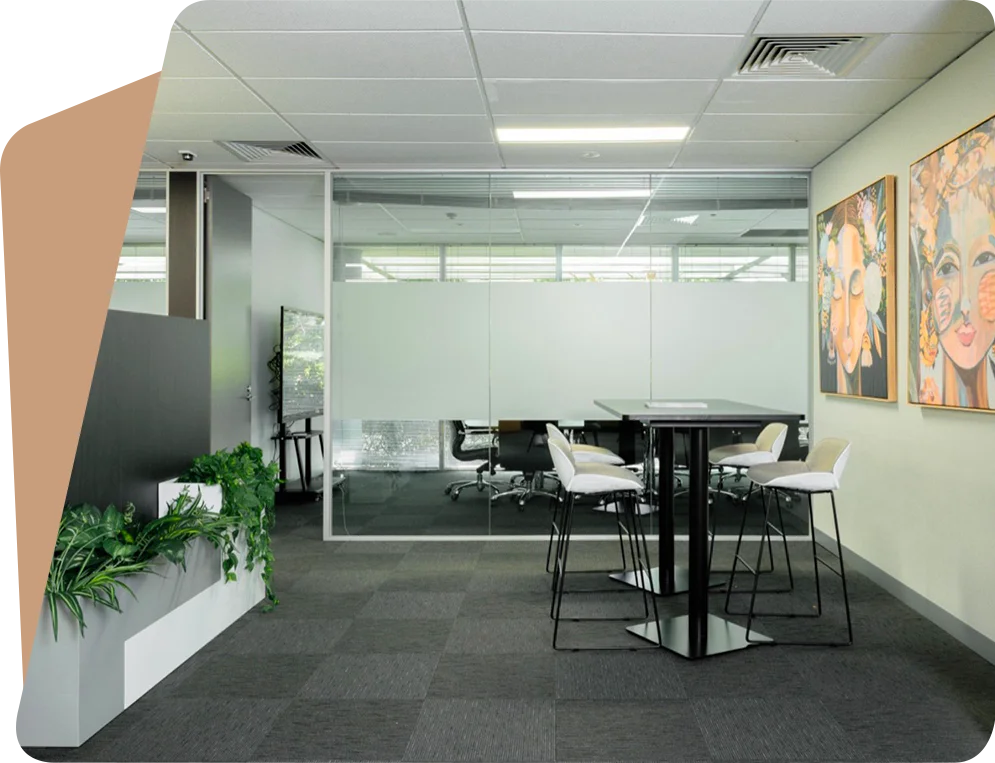

What Sets Us Apart

Experience that Counts

Our 10 years in the industry allow us to guide you every step of the way and help you make optimum financial decisions.

Personalised Home Loan Solutions

As your chosen first home buyer broker, we will tailor our services to align with your goals, preferences, and financial situation.

No Cost to You

With us, you find expert financial advice, guidance, and support throughout your mortgage journey at no additional cost.

Fast and Simple Process

We streamline the entire loan selection, application and approval process and ensure you can move into your first home sooner.

Calculate and Make Informed Financial Decisions

Our Lenders

Cheney and Arabella were wonderful in assisting us and made the whole process very smooth. They were very professional and were great with answering any questions we had.

The best broker I’ve worked with! Highly recommend! They are so professional and effective and can match you with the lowest interest rate with lowest monthly repayment. Fantastic team!

Cheney and Ivy are one of the most professional brokers I have worked with. Their experience, service and expertise impress me every time.

I would really recommend discussing your financing with them, they always have great ideas to solve my clients’ needs.

Frequently Asked Questions

Our first home buyer brokers are financial professionals who act as an intermediary between you (our client) and prospective lenders and help arrive at a favourable agreement for both. We offer comprehensive support – from research and comparing different loan products to selection and streamlining the entire application and closing process; our team will do it all to ensure a seamless experience for you.

You can buy your first home with a deposit of as little as 5%, but the exact amount will vary from lender to lender. How much you can contribute as a deposit is one factor which influences our selection criteria – our first home buyer mortgage broker will only recommend options that fall within your budget. Also, several schemes like the First Home Owner Grant (FHOG) or the First Home Loan Deposit Scheme can help you with your deposit. Connect with us for more information.

Yes, our first home buyer brokers will help you secure all possible government grants and incentives. Several government schemes can support you in your first home ownership journey, and we are familiar with them all. With us, you will not miss out on anything that could help you save on your first home purchase.

There are several advantages of connecting with our brokers instead of going to the bank. While the bank will bring you limited loan products, we will bring you hundreds of options from both leading bank and non-bank lenders; our team will not just give you loan options but also do the legwork for you. Be it assistance with loan comparison, selection, application, approval or annual reviews, we do it all on your behalf and offer support throughout the lifetime of your loan.

Yes, we can help you speed up the entire loan application and approval process. As an experienced team, we are swift in our operations and ensure flawless execution. We will prepare the paperwork to ensure all required documents are in order, and submit a failproof application, preventing delays of any kind.

While it’s not a requirement, getting pre-approval before you start looking for a home can be a smart move. Pre-approval will help you determine your borrowing capacity and direct your search within your budget bracket. It will help you limit and streamline your search to a great extent, saving you time and effort.

Typical documents you'll need include proof of income (such as pay slips or tax returns), bank statements, identification, and details of your current debts and expenses. Once you connect with us, our first home buyer brokers will guide you through the process and ensure you are ready to submit a failproof application.

Yes, you can refinance your first home loan, and our team at Original Wealth can help you with that. If you think your interest rate is no longer competitive, wish to consolidate your debt or are aiming for better loan terms, refinancing can be a good option. Connect with us regarding your refinancing needs, and we will conduct a loan health check to determine whether refinancing is the right choice for you.

When it comes to your home loan, you will have two options – fixed-rate and variable-rate.

- Fixed-rate means you lock in the interest rate and pay the same amount throughout the lifetime of your loan.

- As for variable rates, the interest rate will vary depending on the prevailing market rate and will be subject to fluctuations.

Our first home buyer mortgage broker will take you through both options and help you make an informed decision.

First-home buyers in Melbourne are eligible for stamp duty concessions or exemptions. For properties –

- Valued at $600,000 or less, you get a complete exemption.

- Between $600,001 and $750,000, you get some concessions.

- Costing $750,000 or higher, you get no concession.

Also, to be eligible for the concessions, you must meet some eligibility requirements – for instance, you must be an Australian citizen, and the property should not be previously owned, etc. For more information, get in touch with our first home buyer brokers.

Facebook

Facebook Instagram

Instagram Linkedin

Linkedin Red Book

Red Book